Head of Income: Other Sources

Though the other "Heads of Income" cover everything extensively, what if I won some lottery? Would it be taxable? What if I won in a casino or in a horse race?

In order to avoid the tax evasion from the sources which form the part as a casual income, i.e. income earned by some kind of wagering contract would be included here. Or in other words, we can say, those which happened due to a 'matter of luck' involved in it would be covered here.

This section is a residuary section which covers the miscellaneous provisions related to taxation.

It would be a surprise for the novice, that even the gift received which is above the 50000/- limit would also be taxable!

However, certain relations are exempted (in case the gift is received during the marriage of an individual). However, here the twist comes, and that is #cousins are not involved in this list!

Although, even by reading this much the income tax act may seem like havoc, trust me it isn't.

This blog would simply it in lucid, clear and plain English which can be understood by even an 8th Grade student. Let's begin!

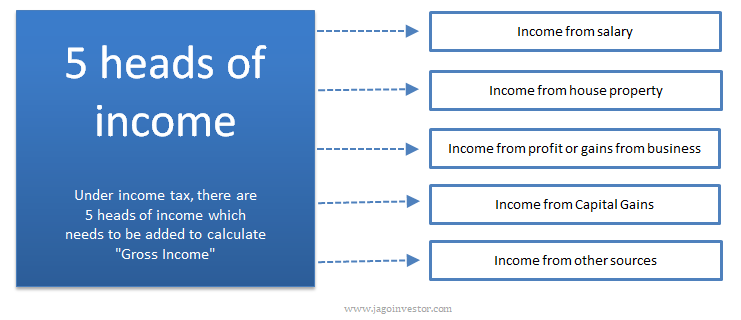

Income from other sources

Income from other sources is the residuary head of income. Income of every kind which is not chargeable under any other specific head of income is taxed under this head

However, we should acknowledge that the income is not fully exempted.

Specific Incomes [Section 56(2)]

The following are the incomes specifically enumerated under this head:

- Dividends (other than those mentioned under Section 115-O

- Any winning from lotteries, crossword puzzles, races including home racing, card games and any other games of the nature of gambling or betting.

- Any income from letting on hire machinery, plant or furniture provided such income is not chargeable under head 'Income from Business or Profession'

- Any income from letting of building on hire along with plant, machinery or furniture fitted therein is also taxable under this head provided the income from such building cannot be separated. It should also be noted that such income is not charged under 'Income from House Property.'

- Funds of Employees: Any sum received by the assessee from his employees as contribution to any Provident Fund or superannuation funds or any other fund for the welfare of Employees' State Insurance Act, 1948 or any other fund for the welfare of such employee. It would be chargeable here in case it was not charged under 'Profits and Gains of Business or Profession'.

- Interest on Securities: It would be chargeable here in case it is not chargeable under the head of 'Profits and Gains of Business or Profession'.

- The amount received under the Keyman's Insurance Policy provided it is not assessed under the head "Salaries" or 'Profits and Gains of Business or Profession'.

- If an Individual or HUF has received during a previous year any sum of money or property without consideration or adequate consideration from any person or persons exceeds Rs. 50000, the whole of such sum would be taxable under the head - 'Income from Other Sources.'

- Interest on compensation or enhanced compensation is also charged under this head.

- Advance money received in the course of negotiation for the transfer of capital assets, if fortified, shall be chargeable to tax under the head 'Income from other sources.'

Deductions available under the Head 'Income from Other Sources:

- A reasonable amount is paid by the assessee by the way of commission to a banker or remuneration to a person who is engaged for the purpose of realising such income on behalf of the assessee.

- In case the income is from machinery, plant, furniture, building etc. being let out on hire, the following deductions are allowed almost on the same lines as it is done in the case of ' 'Profits and Gains of Business or Profession'.

- Current repairs of the building

- An insurance premium paid against the risk of damage or destruction of the premises

- Repairs and insurance of machinery, plant or furniture

- Depreciation on buildings, machinery, plant or furniture on the basis of 'block of assets' as discussed in the 'depreciation, Investment Allowances, etc'.

- From the amount of family pension, a standard deduction equal to 1/3rd of such pension or an amount of Rs. 15000, whichever is less, shall be allowed as a deduction. A family pension means a monthly regular payment payable by the employer to a person belonging to the family of a deceased employee.

- Any other expenditure of revenue nature, which is incurred wholly and exclusively for the purposes of earning such income is allowed.

- Any sum paid as mentioned under the 'Fund of employee' if such sum credited by the assessee to the Employee's Account in the relevant fund/ funds on or before the due date.

- From the interests received on compensation or enhanced compensation, 50% of such income shall be deducted and no other deduction shall be allowed in this respect.

Case Laws

CIT vs Sandhu Brothers

In this case, it was held that if the income is not taxable under any other head of the Income Tax Act, it would be taxable under the residuary head called 'Income From Other Sources.

CIT vs Govinda Chaudhary [1993]

In this case, it was held that if the income is not taxable under any other head of the Income Tax Act, it would be taxable under the residuary head called 'Income From Other Sources.

Padmavati Jai Krishna vs Additional CIT 1987

In this case, it was held that in case the expenditure is wholly or exclusively for the purpose of earning income, it would be taxable under this head.

Dr. Sri HS Gaur vs CIT (1928)

In this case, it was held that the fee received by the professional man as an examiner at the university exam would be taxable under Income from Other Sources.

Juggilal Kamlapal Banker vs CIT

In this case, it was held that the income received from the lease of a factory would be taxable under this head.

CIT vs Lady Navajbai Tata [1947]

In this case, it was held that the commission earned by the director of the company at the time of negotiation of the sale of shares would be taxable under this head.

CIT vs G. Hyatt

In this case, it was held that the interest on the unrecognised provident fund would be taxable under this head.

Conclusion

From the above discussion, we see that the income tax act is beautifully arranged in a marvellous chronology. The need of the hour is to cement the loopholes present in the system so that an adequate amount of revenue can be earned in order to build good infrastructure. It is only with the collective effort that one day India would be a global power.

Comments

Post a Comment